Total surplus with a binding price floor 0 2 4 6 8 10 12 14 16 18 0 2 4 6 8 10 12 14 16 18 20 p q price floor b b b b b b b a b c e d f g price floor.

Does a binding or not binding price floor create surplus.

How price controls reallocate surplus.

In this case the price floor has a measurable impact on the market.

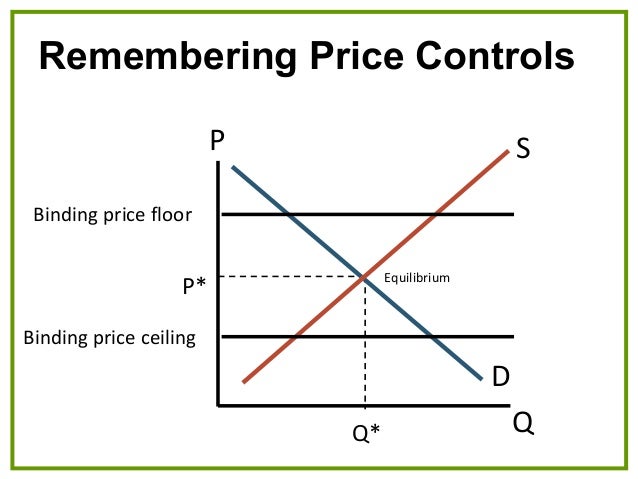

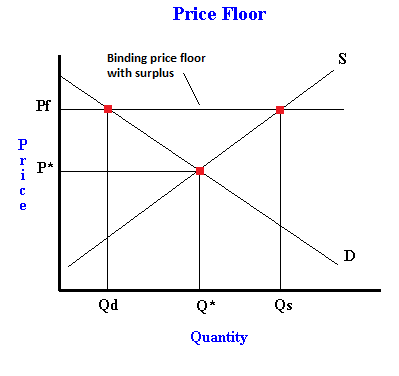

A binding price floor is a required price that is set above the equilibrium price.

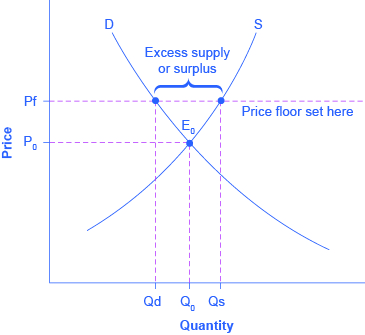

An effective binding price floor causing a surplus supply exceeds demand.

Governments usually set up a price floor in order to ensure that the market price of a commodity does not fall below a level that would threaten the financial existence of producers of the commodity.

Because the government requires that prices not drop below this price that.

Minimum wage and price floors.

It ensures prices stay high causing a surplus in the market.

A inefficiently low quality b inefficient allocation of sales among sellers c wasted resources d the temptation to break the law by selling below the legal price.

The persistent unwanted surplus that results from a binding price floor causes inefficiencies that do not include.

Qs 1 5714 0 7857p demand.

Price ceilings and price floors.

When a price floor is set above the equilibrium price as in this example it is considered a binding price floor.

The result is a quantity supplied in excess of the quantity demanded qd.

When quantity supplied exceeds quantity demanded a surplus exists.

Another way to think about this is to start at a price of 100 and go down until you the price floor price or the equilibrium price.

Taxation and dead weight loss.

By contrast in the second graph the dashed green line represents a price floor set above the free market price.

The government is inflating the price of the good for which they ve set a binding price floor which will cause at least some consumers to avoid paying that price.

A binding price floor occurs when the government sets a required price on a good or goods at a price above equilibrium.

Types of price floors.

The effect of government interventions on surplus.

Price floors set above the market price cause excess supply a price floor set above the market price causes excess supply or a surplus of the good because suppliers tempted by the higher prices increase production while buyers put off by the high prices decide to buy less.

This has the effect of binding that good s market.

Price and quantity controls.

Example breaking down tax incidence.

Qd 19 6154 1 1538p rewriting.

This is the currently selected item.