D s most recent quarterly dividend payment was made to shareholders of record on sunday september 20.

Dominion energy dividend rate.

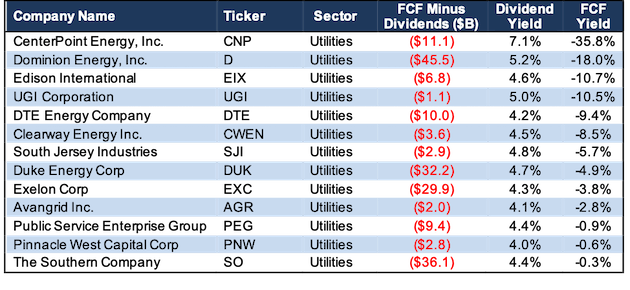

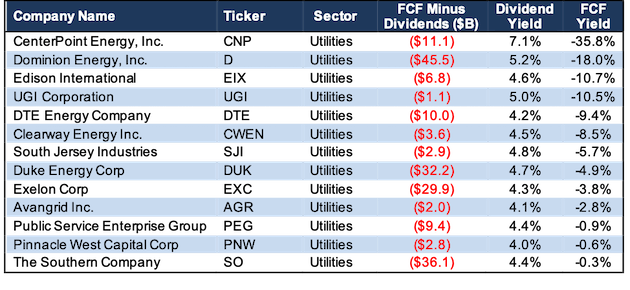

Dominion energy inc d announced a dividend cut this past week.

Dominion energy is taking several steps to reduce risk.

Find the latest dividend history for dominion energy inc.

A cash dividend payment of 0 94 per share is scheduled to be paid on september 20 2020.

We estimate future payouts by applying the lowest growth rate negative growth rates included to the most recent payment.

By the end of the year it plans to cut its dividend by 28.

This ends an 18 year track record of annual dividend increases.

The company s business consists of electric power generation and transmission and natural gas.

D will begin trading ex dividend on september 03 2020.

It was tied to two other events.

Last updated on september 22 2020 by dividend power.

In early july giant u s.

Shareholders who purchased.

D is an energy producer and transporter.

Utility dominion energy nyse d announced that it was making a big change.

Dividends can be paid by check or electronic deposit or may be reinvested.

Select my state select state idaho north carolina gas north carolina electric ohio south carolina utah virginia west virginia wyoming go to this state s site.

That new rate will improve its dividend payout ratio from 85 to 65 with the latter more in line with the utility industry s leaders.

I just learned that dominion energy d is going to cut annual dividends to 2 50 share from 3 76 share.

Proceeds will be about 3b as the deal includes the assumption of 5 7b in debt and taxes.

Dominion energy pays an annual dividend of 3 76 per share with a dividend yield of 4 82.

Dividends on dominion energy common stock are paid as declared by the board of directors.

One event was the approximately 9 7 billion sale of dominion s natural gas transmission pipelines and storage segment to warren buffett s berkshire hathaway brk a and brk b.

Dividends are typically paid on the 20th day of march june september and december.

The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of 9 44 each year.

The company is selling assets to berkshire hathaway.